How Michigan Manufacturers Can Leverage Foreign Trade Zones Amid Evolving Tariff Pressures

As trade tensions escalate and tariff rules evolve across the globe, Michigan manufacturers are feeling the pressure, especially those sourcing components internationally and serving customers across North America. In particular, the U.S.-China and U.S.-Mexico tariff environments are pushing companies to rethink their import strategies. For many, the answer lies in leveraging a Foreign Trade Zone (FTZ), a powerful tool that can mitigate duty exposure, reduce costs and add critical flexibility to supply chain operations.

As trade tensions escalate and tariff rules evolve across the globe, Michigan manufacturers are feeling the pressure, especially those sourcing components internationally and serving customers across North America. In particular, the U.S.-China and U.S.-Mexico tariff environments are pushing companies to rethink their import strategies. For many, the answer lies in leveraging a Foreign Trade Zone (FTZ), a powerful tool that can mitigate duty exposure, reduce costs and add critical flexibility to supply chain operations.

“We’re seeing more Michigan manufacturers take a serious look at FTZs, not just as a cost-savings mechanism, but as a strategic shield against trade uncertainty,” says Paul McDonald, a seasoned industry executive with ALS. “With shifting tariffs, evolving USMCA rules and rising global freight volatility, FTZs offer manufacturers the control and flexibility they need to protect margins and stay competitive.”

What Is a Foreign Trade Zone (FTZ)?

An FTZ is a secured, designated location in the U.S., authorized by U.S. Customs and Border Protection (CBP), where imported and domestic goods can be stored, processed, or assembled before entering U.S. commerce. Duties are deferred when they are admitted into the zone or extracted from the zone, based on tariff classification and country of origin. If they are re-exported, duties may be eliminated entirely.

Automated Logistics Systems (ALS), a Transport Topics Top 100 3PL services provider headquartered in Michigan, operates an FTZ warehouse in Jackson and they have helped a growing number of automotive and industrial manufacturers use this structure to navigate volatile trade conditions and rising import costs, particularly in response to shifting U.S. trade policies.

Tariff Landscape: U.S. – China and U.S. – Mexico in Focus

U.S.-China

- Tariffs on Chinese imports remain in place and continue to affect a wide range of goods, especially key components like electronics, auto parts, and industrial equipment. Ongoing reviews by U.S. trade officials could lead to changes—including more tariffs or fewer exemptions—making it harder for manufacturers to plan ahead. This creates pricing pressure and unpredictability for businesses that rely on Chinese suppliers.

U.S.-Mexico

- The U.S.-Mexico-Canada Agreement (USMCA) still allows many products to cross the border duty-free — but only if strict rules are met. Increased enforcement around origin documentation, labor content, and production value has made compliance more complex. Missed details can result in costly penalties or denied duty-free status. At the same time, border wait times, inspections, and political uncertainty are adding friction to U.S.-Mexico supply chains.

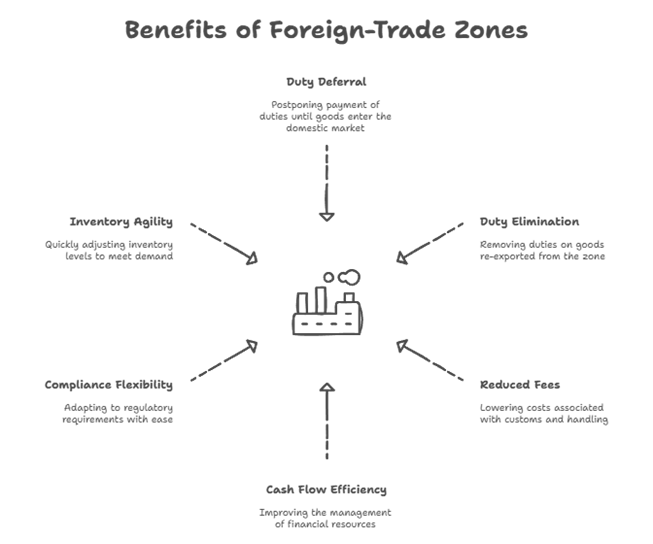

Benefits of Using an FTZ

- Duty Deferral — duties are deferred when goods are admitted into or withdrawn from the zone, depending on tariff classification and country of origin

- Duty Elimination — Goods exported from the FTZ are exempt from U.S. duties

- Reduced Fees — Consolidated customs filings reduce brokerage and processing costs

- Cash Flow Efficiency — Deferring payments keeps more capital available for operations

- Compliance Flexibility — FTZs offer a buffer for items that may not meet USMCA origin thresholds

- Inventory Agility — Held goods are tariff-free while market or demand conditions stabilize; and potential to mitigate inventory carrying costs depending on the INCO term used

(click for larger image)

Real-World Example: Automotive Supplier Adapts to Tariff Volatility

A mid-sized Tier 1 automotive supplier importing critical components from China faced significant cost increases when those parts were recently reclassified under a reinstated tariff category. Compounding the challenge, their final product was destined for both U.S. OEMs and assembly plants in Mexico, triggering different tariff exposures based on destination and compliance.

By shifting operations into ALS’s FTZ in Jackson, they were able to:

- Defer $8M+ in annual duties

- Avoid U.S. tariffs on re-exported units heading to Mexico

- Reduce customs fees by filing consolidated weekly entries

- Improve compliance when USMCA origin status was uncertain for specific parts

This move not only saved them money but gave their supply chain team greater control in navigating compliance for multi-country distribution.

When Should You Consider an FTZ?

Michigan manufacturers should evaluate FTZ use if they:

- Import goods from China, Asia or non-USMCA countries

- Serve customers in both U.S. and Mexico

- Face increasing compliance complexity under USMCA

- Need to optimize cash flow or mitigate tariff risk

- Have volatile or seasonal demand

Conclusion

As an affiliate member of the Michigan Manufacturers Association (MMA) and a logistics partner to many of the state’s most recognized manufacturers, ALS encourages industry leaders to consider how FTZ use can align with their operational, financial and strategic goals. This is not just a large enterprise solution, it’s a practical, proven model that can support cost savings, compliance, and competitive edge for Michigan manufacturers of many sizes.

Want to learn more? Connect with a licensed FTZ consultant or customs advisor to evaluate your import strategy, tariff exposure and operational fit for FTZ integration.

About the Author

Paul McDonald is a log time employee and Strategic Advisor for ALS that brings 30+ years of global supply chain leadership, specializing in logistics strategy, network optimization, and guiding teams to avoid costly pitfalls and drive measurable improvement. He can be reached at pmcdonald@automatedlogistics.com.

Paul McDonald is a log time employee and Strategic Advisor for ALS that brings 30+ years of global supply chain leadership, specializing in logistics strategy, network optimization, and guiding teams to avoid costly pitfalls and drive measurable improvement. He can be reached at pmcdonald@automatedlogistics.com.

Automated Logistics Systems (ALS) is an MMA Basic Associate Member and has been an MMA member company since September 2024.

Automated Logistics Systems (ALS) is an MMA Basic Associate Member and has been an MMA member company since September 2024.